Landlords strive to increase the value of their properties by enforcing clauses in the veterinary office lease that enable them to raise rents, threaten their tenants with eviction, or prevent them from selling their clinics. The office lease should act as a tool to protect and support the success of a veterinary clinic; not the opposite.

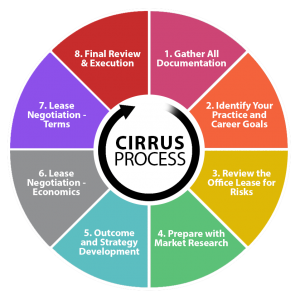

The following is an overview of Cirrus’ tried and tested “Strategic Office Lease Negotiation Process”, designed and developed over 20 years to help veterinarians secure the best deal possible, with fair and economic lease terms that prevent landlords from gaining an unfair advantage.

Step 1) Gather and Assemble the Office Lease Documentation

Step 1) Gather and Assemble the Office Lease Documentation

Collect all the relevant lease documents ahead of time to ensure you have all the information and necessary facts in one place for a full understanding of the big picture.

Step 2) Identify Your Practice and Career Goals

Determine your long-term practice goals, and how they relate to your tenancy. What stage are you currently at in your veterinary career? Are you planning to retire the next 5-10 years? Do you have plans to expand your clinic in the future? Do you plan to bring in associates? Are you going to branch out and offer alternative services to your customers like grooming or boarding? Mapping out your clinic goals in advance will help you determine how your lease should be set up and what you need it to do for you, shaping your lease negotiation strategy.

Step 3) Review the Office Lease for Risks

Once you’ve defined your goals, it’s time to review your lease agreement lease from start to finish, identifying any problem areas or risky clauses within. Language in the lease is often difficult to understand and written in a way that only favors the landlord, presenting multiple road blocks to vets at pivotal stages in their career.

Items to Consider in the Lease:

- Personal Guarantee: Have you signed the lease in your personal name, thereby giving the landlord the right to pursue your personal assets in the event of default? Will you remain personally liable for rents when you transfer the lease to another veterinarian at transition time?

- Relocation Clause: Is there a relocation clause in the lease that gives your landlord the right to relocate your clinic? Over 75% of doctors never make it to the end of their career in their current location without being relocated at least once by their landlord. Clinic relocations can cost $250,000 or more in demolition, renovation, moving and build-out expenses. Who pays for the move; you or the landlord?

- Options to Renew: Do you have “options to renew” built into lease; and if so, are these options transferable to a future buyer or do they disappear after the lease is transferred?

- Exclusivity Clause: Does your lease have exclusivity provisions that protect your business and prevent your landlord from moving competing clinics into the building/center?

Once these and other issues have been identified, it’s time to prepare an office lease negotiation strategy to improve or remove them altogether. Develop a strategy to either eliminate or amend these clauses, and be ready with “preferred alternatives” in the event your landlord is unwilling to negotiate.

Step 4) Prepare with Market Research

Educating yourself about market conditions in and around your clinic is a surefire way to prepare for your negotiation and ensure you’re getting the best deal. Being aware of existing competition, rental rates in your neighborhood, and local vacancy rates puts you at a huge advantage in negotiations. You’ll be in a place where you understand what you rightfully deserve; giving you the confidence to get it.

Cirrus Consulting Group has access to exclusive local veterinary and commercial office real estate data that we use as negotiating tools to get our clients the best deal.

Step 5) Outcome and Strategy Development

Step 5) Outcome and Strategy Development

Develop a strategy for improving the terms in your office lease. What are you trying to achieve in the negotiation? What are your priorities, and what is the best treatment plan for attaining them? Do you have any leverage you can use towards getting what you want?

Step 6) Lease Negotiation – Economics

Tackle the financial aspects of the lease with your landlord first, discussing your rental expectations. Ensure all the “wins” of the discussion are documented on paper, aiming to keep the discussion formal and as brief as possible.

Try not to focus too much time and energy on the rental rates; securing fair terms in the lease that will protect you from expensive traps in the long run is a far more significant “win”.

Step 7) Lease Negotiation – Terms

Once you’ve addressed the lease economics, you can begin negotiating the risks and detrimental clauses highlighted previously out of your lease. At this stage, it’s important to remember your practice priorities such as flexibility, protection and location security. These are all key factors to consider when negotiating the lease terms with your landlord.

Step 8) Final Review & Execution

Prepare the final lease document and give it a thorough review before signing it. Get the final sign-off from the landlord, make copies, and store them somewhere safe.

Track your office lease expiry and renewal dates, and always give yourself 18-24 months to begin the lease negotiation process. Without properly preparing for your lease negotiation in advance, you could be critically jeopardizing your investment and putting yourself and family at risk. Research and a solid lease negotiation strategy are critical to the success and longevity of your practice.

Schedule your personalized office lease consultation with an expert today!